Ali, Disney, Goldman Sachs and other heavy gold holding, "mobile version of Na fei" why not quickly? Prism.

Special Author . . Li Ran Editing by . . Yang Wei

Products . . Prism Tencent Xiaoman Studio

Welcome to Tencent News APP to read more quality information

"It's all about the new crown."

For Jeffrey Kazanberg, the former founder of DreamWorks, the past month has not been a great one.

A month ago, Quibi, a two-year-old short-video platform, went live. The new video platform, backed by alibaba, Disney, Warner, Sony, Universal, Goldman Sachs, JPMorgan Chase, Viacom and other big-name shareholders, received nearly $1.8 billion in financing before going live, producing 50 debuts as soon as it called it, and announced that it would launch 175 productions in its first year, for a total of 8,500 episodes.

"Game of Rights" "Sansa" Sophie Turner, "24 Hours" starring Kiefer Sutherland, director Spielberg, "Spider-Man" series director Sam Remy, "Waterform" director Gilmore de Toro ... Hollywood's top talent is lining up to film Quibi.

A month later, however, Quibi produced nearly 50 debuts, none of which set off the water. In the month since it was online, Quibi has gained just 3.5 million download users, while third-party data is even lower, at 2.9 million.

In an interview with The New York Times, Mr. Kazanberg, who has always been a straight-talker, blurted out, "This number is completely out of our expectations (It's not close to what we wanted.). "

Also during the outbreak, Netflix added 15.77 million subscribers in the first quarter of this year, a quarterly high;

As a last-minute move, Quibi announced in late April that the first two episodes of "The Most Dangerous Game" and "Stranger Things" would be put on Youtube in the hope of sparking a conversation and attracting more users. Also short video, Youtube was a competitor Quibi wanted to disrupt.

Amazon, Netflix, Apple, Disney... Streaming war has clearly been white hot, Quibi's big-handed killing of the bottom gas in the end from where? If it ends up killing a world, what can Quibi do for other short video platforms?

Phone-side Netflix, cost-effective "Game of Rights"

What's Quibi? It will cost $5 million to make this clear.

Three months ago, the little-name streaming company used that number to buy the "Super Bowl" ad slot. In the 30-second sky-high ad, in the face of the comet's imminent impact on earth, the black female president actually did not panic out his cell phone, open Qubi, decided to watch a play to relax.

Quibi's name is actually an abbreviation for "quick bite", which is the meaning of "fast food". The video, which is made for mobile phones only and is no longer than 10 minutes long, targets the time it takes for young users to commute to and from work, queue at Starbucks, hospitals or wait at airports.

The work is short and shrewd, but Quibi's ambition is not small. In addition to most short video platforms, Quibi does not choose the low-cost, fast-impact UGC (user production content) model, one is PGC (professional production content).

Opening Quibi's list shows that its content layout is almost built on the same page as long-form video platforms such as Netflix and HBO, while absorbing popular content from short-form video platforms such as YouTube.

Specifically, Quibi's work falls into three categories:

1, the film broadcast in chapters. Quibi calls such works the "Beacon" project, and the one- or two-hour-long film will be released in a dozen clips, each for up to 10 minutes.

Quibi's debut production of "The Living", from the official push

2, reality TV, documentaries and other unplayed programs. This category covers Hollywood's hottest unwritten shows of the day, from National Geographic Channel, Discovery-style straight-men racing, to female-toned cooking shows, cross-dressing shows, dating shows, family-to-nature documentaries, and MTV shows that were popular with teenagers in their early years.

3, daily news collection. Quibi has worked with the BBC, CBS, NBC, ESPN, TMZ, Rotten Tomatoes, Entertainment Weekly and other media to launch short news programs in the fields of ana events, sports, entertainment, music, celebrity gossip, and targeted content for black, Latino, Canadian users, and even weather forecasts for five to six minutes.

Quibi values the Lighthouse project the most. Among the debuts, "Sansa" Sophie Turner's "Survival" is a disaster survival theme, adapted from the best-selling novel, "The Most Dangerous Game" starring Liam Hemsworth is a brain-burning suspense work, and the new version of "Dead End" is the most typical Hollywood action movie.

These projects are quite money-burning. According to The Verge, the Lighthouse project costs up to $125,000 per minute and more than $1.25 million for a 10-minute episode. According to the 40- or 50-minute calculation of the American drama, Quibi's top-of-the-line work has cost as much as the investment in Game of Thrones when it was just its infancy.

If reality TV is to attract segmented user groups, short news is to retain users to improve daily life, this kind of cinema-level production is Quibi's top priority, bear a gun and red, quickly attract users task. However, it's unheard of to break up a dozen short videos from a movie-level production in Hollywood or other countries.

Quibi founder Kazanberg says he was inspired by Dan Brown's novel.

He shared his thoughts last year at the South by Southwest Festival- the novel's hundreds of chapters, each of which took about half an hour to read, for the simple reason that the reader's eyes would be sour for a long time. By the time of the Da Vinci Code, it was even worse: the book was more than 440 pages long, divided into more than 100 chapters, with an average of four or five pages.

Kazenberg wants to move this idea to the film and television content. "If it succeeds, it will be the third revolution in film narrative after film and television."

"Water gun to cannon"? No, its opponent is Youtube

Judging from the response of the first works on the line, Kazanberg's master is not quick. Big Investment's "Live" scored 6.5 on IMDb, Stranger with 6.9 and "Most Dangerous Game" with a best rating of 7.8.

Most not least, several productions were rated by only one or two hundred people, far behind the tens of thousands of new Netflix dramas "Hollywood" and Apple Tv Plus's "Defending Jacobs" in the same period. In other words, a month after it was online, Quibi hasn't had a work that's hot.

In fact, since Kazenberg came up with Quibi's idea two years ago, the voices of doubt have not stopped. The first question is: Is there enough money?

Watching Netflix replace Hollywood, streaming has been springing up for nearly a year or two, and there are big people willing to throw money at it. Amazon, which owns the Lord of the Rings, spends $5 billion a year, Disney has a budget of $6 billion a year for Disney and Hulu, and Netflix is burning $17 billion this year.

The least like Apple's Apple TV plus, Warner's HBO Max, spends at least a billion or two billion dollars a year to qualify for the war.

In March, Quibi completed a new round of financing, with a total of $1.75 billion before it companies go online. Some analysts describe it as "like shooting a cannon with a water gun".

In response, Mr. Kazanberg countered that other platforms cost an average of $100 a minute for content and $100,000 for Quibi for a minute.

Another point that has been questioned is the fee - although it's short video, Quibi doesn't have much of an advantage in charging. There are two modes of Quibi users' monthly fees: $8/month to skip ads, $5/month to watch a small number of ads, free for the first three months of registration. Disney plus for $6.99, Disney partners can buy a new iPhone for a full year for free, and the same ad-free Apple TV plus for $4.99.

In addition, Disney Plus, HBO Max, Peacock and other streaming media, back to their respective parent companies, as soon as the launch of their own mass library. Quibi, which doesn't have a library, can only start from nothing.

That's why Mr. Kazenberg has had to stress repeatedly that Quibi is not targeting major streaming platforms such as Netflix and Disney Plus, but is targeting short video more for users of short video platforms such as Youtube, TikTok and Snapchat.

Youtube had more than 2 billion monthly users in the first half of last year, and the global download volume of TikTok, the "overseas version of Jiyin", had already exceeded 2 billion by April this year, and the habit of users watching short videos on their mobile phones had already been established.

Another data is also good for Quibi-- for the first time in 2019, according to eMarketer, U.S. adults spent more time using their cell phones per day (3.71 hours) than Americans watched television per person per day (3.58 hours).

Kazanberg believes that some of the existing users of major platforms must have higher requirements for short video: more professional production, undisturbed by advertising. This group, even if only 1% of Youtube's monthly live, is 20 million users.

In other words, Quibi wants to use the content level of the shoulder-length video to attract users of the short video platform. But such a unique positioning, has not yet seen a successful case.

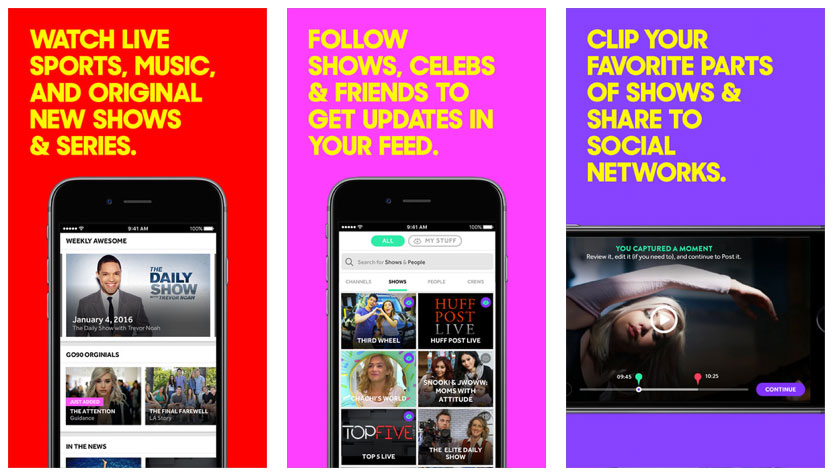

In 2015, VERIZON, the US communications giant, launched a platform called Go90, similar to Qubi's positioning: for younger users, it also offers a variety of news programs, reality shows, sports shows, episodes on major television stations, and allows users to clip content into short videos to share online.

Verizon's Go90 has been shut down

But Verizon recorded a loss of nearly $700 million as last-minute active users fell far short of expectations and Go90 was forced to shut down in 2018.

Perhaps it's because of the forefast that Quibi strategicly tilts further toward the phone: in addition to the rigid requirement that all content is controlled within 10 minutes, Quibi consciously emphasizes the innovation of viewing mode.

As early as a year ago, Quibi began to promote its exclusive seamless screen conversion technology, where users can view content on a horizontal or vertical screen at any time, and the screen will automatically fit. Quibi also automatically adjusts the brightness and sound of the video based on changes in indoor and outdoor light and noise.

Quibi allows users to seamlessly switch between vertical screens

Some of the works on the line at the follow-up meeting will be even bigger. "Number One Player" star Tey Sheridan's "Wireless" for Quibi, a large number of shots are taken on a mobile phone, online will allow users to switch between front and rear lenses.

Spielberg is working on Quibi's horror-themed "After Dark." In particular, he asked users to watch the work after dark. To do this, Quibi will be dedicated to the online countdown software, to determine the user's location after dark will prompt the program online.

Why do the big guys bet on the group?

Despite the constant skepty, Hollywood has long been behind Quibi.

In April 2017, Kazanberg announced that Qubi had completed its first round of financing of $1 billion. The first round of funding was made up of Hollywood's "big six" - Disney, Fox, NBCUniversal, Sony Pictures, Paramount's parent company Viacom and Warner. Lionsgate, 007-owned MIG, British television giant ITV and Piggy Page's copyright holder, Entertainment One, are also involved in the financing.

On the list of strategic investors are Madrone Capital of the Wal-Mart Walton family, Liberty Global of Goldman Sachs, JPMorgan Chase and John Malone, the godfather of American cable television, and Alibaba of China, which became an investor for the first time. By March, Quibi had made another round of financing to major investors.

Among them, Disney itself has Disney plus and Hulu, Warner and NBCUniversal are about to launch HBO Max and Peacock, and even Wal-Mart has its own streaming business plans.

Why would these companies be willing to bet on both ends?

In an effort to attract Hollywood talent, Quibi's offer is attractive, and in addition to a 20 per cent price increase in production costs, there's a big trick : creators actually own IP rights.

As mentioned earlier, the works on Quibi's line are actually films that are divided into more than a dozen chapters. Two years after the works go on sale, the creators have the right to sell the full film version to other platforms. Seven years after Quibi went online, all copyrights to the work, including potential proceeds from subsequent derivatives, will be returned to the creators.

The current popular model of major streaming media is the other way around.

Streaming, represented by Netflix, is generally inclined to pay a one-time creative fee in order to attract big-ticket franchises and rapidly expand its copyright pool, with many first-tier stars getting paid more than $20 million, which is rare in Hollywood blockbusters.

However, although the stars can get more money before the auction, but also means to talk to the copyright of the work and derivative income and other follow-up earnings.

That's why Mr Kazenberg believes that under copyright models such as Quibi, streaming streaming such as Netflix, Hulu and Amazon will not only be Quibi's competitors, but potential buyers.

Quibi's reputation in the industry, on the other hand, is why the capitals are willing to cash checks.

Kazanberg, 69, has been in Hollywood for more than 50 years. After graduating from high school at the age of 16, Kazanberg went to Hollywood to fight and became president of Disney Pictures along the way. During his time in office, Disney released classics such as The Little Mermaid, Aladdin, Beauty and the Beast and The Lion King.

In 1994, Kazanberg chose to leave, teaming up with Spielberg and David Geffen to set up DreamWorks, which he overstevent over the next 20 years with big-selling animated series such as Shrek, Kung Fu Panda, Dragon Trainer and Madagascar. In 2016, Comcast bought DreamWorks Animation for $3.8 billion, and Kazanberg is worth hundreds of millions of dollars.

With the success of DreamWorks Animation, the outside world is afraid to let go of Kazanberg's second venture. In Hollywood's old saying: Don't go against Kazanberg because he's always right.

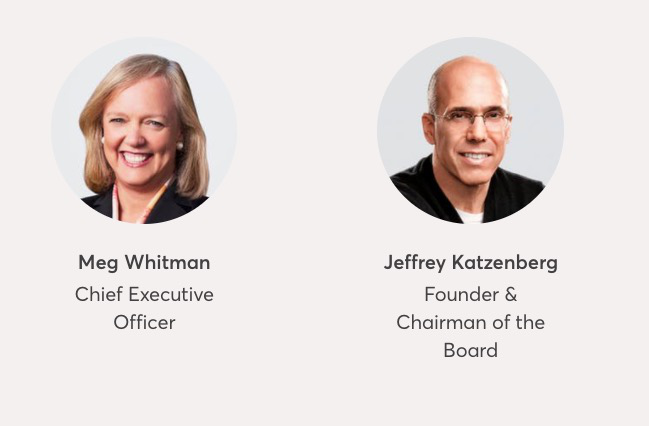

Not only that, but Kazanberg brought in "friends" Megan Whitman as CEO, and she and Kazanberg met when they worked at Disney in the 1980s.

Megan Whitman, 64, served as eBay's head for a decade, during which time eBay's sales grew from millions of dollars to billions of dollars. In the 2000s, she took over as HEW's CEO, completing the big move to split HP into two.

From Quibi's official website

With Whitman,Quibi pulled in $150 million in ads last year, including General Mills, Taco Bell and T-Mobile, before it went online.

The outbreak is good for streaming, but Quibi is miserable

Unfortunately, the outbreak struck suddenly. Home users suddenly have a large amount of free time, the need to consume fragmented time disappeared. Quibi, which is located on the mobile phone side, does not support TV casting.

Statistics show that Quibi has only 3.5 million download users in a month.

By contrast, Netflix added 15.77 million subscribers in the first quarter, double its previous estimate of 7.5 million and a quarterly record for new subscribers. As a result, Netflix's share price has recently hit a record high, with a market capitalisation of more than $190 billion as of early May, comparable to Disney's.

Mr. Kazanberg has repeatedly said in public that Quibi was more like HBO in the early 1990s: public television was still in its prime, but HBO was half-way through, bringing a more critical narrative that led to the rise of cable television.

If successful, Quibi will not only open a whole new entrance to Hollywood content, but also provide a whole new path for all short video platforms.

Globally, short video platforms almost always rely on UGC (user-produced content) to start, whether it's YouTube, the first computer in the U.S., Snapchat, or China's B-station, Fast Hand, Jiyin, TikTok and other products.

The advantage of UGC is that content costs are low and it is easy to gather users quickly. But at the end of the user surge curve, short video platforms generally face bottlenecks: How does the platform retain users after user freshness has passed? How do I extend a user's retention time?

Some platforms have moved to puGC mode, relying on initial institutionalized content producers to improve production, including YouTube, B-Station, Snapchat, Jiyin, TikTok, which are now seeing more and more vertical V or internet red, making a huge contribution to the platform's traffic.

Others have opted to significantly increase content spending and transition to more professional long video production.

YouTube has fully upgraded its original content service as early as 2018, launching original content brand YouTube Originals, which includes episodes, star documentaries and more, and charges users as part of YouTube Premium.

Justin Bieber's personal documentary, which debuted in the first quarter of this year, is the brand's new production, with 32 million hits in its first week on the web, breaking the record for the first week of original YouTube content.

However, in the more testing content level of the content of the series, from the short video start youTube does not have any advantage, the launch of "Pulse", "Cobra" and other episodes of the performance of edgy, in the public opinion field no water, user interest is depressed. So much so that starting last year, these paid episodes and variety shows had to be switched to free airing.

In China, byte beat choose to watermelon video as the main force of long video, in the past two years has launched a homemade variety, domestic drama, overseas drama and other long video content, this spring to buy the hospital line blockbuster "Mom" decision has caused industry shock.

The short video's fast starter also launched its first solo home-line film on Mother's Day on May 10.

However, the long-range video content reserves of these short-video platforms are quite limited compared to Netflix, Disney Plus, etc.

Quibi plans to launch more than 8,000 episodes a year, apparently in preparation, but the competition is intensifying. Netflix has previously launched a new comedy show, The Comedy Line, which is only about 15 minutes long, far short of the usual length of an hour's jump on a talk show. The show's launch has been the result of speculation that Netflix intends to pull the page on short video content.

Mr Kazanberg says Quibi is not pursuing a Netflix-style path: rapid user growth through money-smashing investments, and then looking back on how to make a profit.

"Megan and I have both been CEOs of public companies, so we know that Quibi's business has to be reliable, repeatable and predictable." In other words, Quibi needs to prove more quickly that its business model is profitable.

But how many people are willing to pay for Quibi? Quibi is a free trial period for users for the first three months and will not have any subscription revenue. Even if all 3.5 million users stay to pay after three months, Quibi's monthly revenue is only $17.5 million to $28 million, barely covering the cost of one or two top-of-the-line productions. What's more, of Quibi's official 3.5 million download users, only 1.3 million are active.

In an interview with Variety, Whitman also admitted that Quibi's first month on the line was "slightly below expectations." In response, Quibi has stepped up its efforts to boost the popularity of its entire youTube stream, while planning to launch a screen-casting feature in May to meet users' needs during the outbreak.

After all, in the words of a Forbes article, if even Kazanberg can't bring Hollywood's top content to the mobile age, no one can.

Resources:

Jeffrey Katzenberg Blames Pandemic for Quibi’s Rough Start, NYT;

Jeffrey Katzenberg’s ‘NewTV’ Startup Closes $1 Billion, Variety;

Quibi Raises Additional Funds Ahead of Launch, WSJ;

Jeffrey Katzenberg & Meg Whitman Keynote at SXSW 2019;

Quite versus the World, The Verge;

Meg Whitman Calls Launch Slightly Below Expectation, Deadline;

Jeffrey Katzenberg’s $1bn “quick bite”, Financial Times;

Disruptors: Jeffrey Katzenberg, Forbes;

Thank you for reading, welcome to leave a message after the text and click "Look at",Message like first place and more than 60,Get a monthTencent Video MemberOh, yes (Deadline:Next Monday at 18:00 p.m.00)

Focus on China's scientific and technological innovation, write in-depth business stories

Welcome to the DeepNet Public Number to read more high-quality original content.

Scan the code to view articles related to Tencent News Client

The copyright of this article belongs to "Tencent News", if you need to reproduce please leave a message after the text, after permission can be reproduced, and in the beginning of the text to indicate the source, author and editor, the end of the text attached a prism two-dimensional code.

Article 645Period.

Typography: Chen Shiyu Huangga

You."Looking at it."Am I?

Go to "Discovery" - "Take a look" browse "Friends are watching"